The Seduction of FIRE

YouTube is flooded with videos proclaiming early retirement success: “I retired at 32!” “How I quit my 9-5 forever!” These stories—often under the FIRE (Financial Independence, Retire Early) banner—spark dreams of liberation and a life of leisure. For many, the idea of walking away from the traditional grind is magnetic. But beneath the surface of those success stories lies a more nuanced, and sometimes neglected, truth.

Retirement Isn’t What It Used to Be

The word “retirement” still conjures up images of elderly people on golf courses or lounging on beaches, enjoying a slow life after decades of hard labor. But when it comes to early retirement, especially among the FIRE community, the narrative gets murkier. What does it really mean to retire at 35 or 40?

To some, retirement means freedom from financial stress. To others, it’s an opportunity to travel, pursue passions, or relocate to a dream country. But for many who spent their lives working a 9-5 job, suddenly not working can feel less like a dream and more like a nightmare.

The Black Hole of Early Retirement

One rarely discussed outcome of early retirement is the existential vacuum it can create. Many people underestimate how much their identity, purpose, and self-worth are tied to their work. When that disappears, they’re left asking:

- Who am I if I’m not what I do?

- What gives my life structure and meaning now?

- How do I wake up with direction when there’s no boss or deadline?

Without answers, early retirement can lead not to freedom, but to a crisis.

FIRE Isn’t One-Size-Fits-All

The core issue is that FIRE is deeply personal. Some dream of perpetual travel. Others want to live a slow, rural life. But FIRE plans often gloss over the importance of vision. The goal shouldn’t just be to escape the 9-5. The real question is: what kind of life are you building toward?

Without a clear answer, early retirement can feel like jumping out of the frying pan into the void.

A Personal Note: From Stagnation to Freedom

In my own life, I had been working toward financial independence in my late 30s. But I was still afraid to let go of my 9-5 desk job. It wasn’t until I was unexpectedly fired in my early-40s that everything changed. Surprisingly, I felt grateful. My ex-boss gave me the push I couldn’t give myself.

That moment forced me to reevaluate everything. Without the constraints of my old job and the stagnating environment around it, I took the leap. I relocated from the Netherlands to Japan and started over. It wasn’t easy—but it was necessary. Financial independence gave me the structure to make it possible, but the real journey started after the job ended.

The Myth That Freedom Equals Happiness

There’s a widespread belief that freedom from work will automatically bring happiness. But if you were unhappy before retiring, financial freedom won’t magically fix that. In fact, it might amplify existing issues:

- Emotional wounds or unprocessed experiences

- Lack of direction or life planning

- Fragile self-esteem tied to productivity

Financial independence without emotional intelligence or purpose can leave people drifting. This is especially true for those who retire early without ever pausing to ask: what makes life worth living for me?

Structure Still Matters

One of the underappreciated benefits of a job is structure. It organizes your time, social interactions, and even your identity. Early retirees who don’t replace that structure often struggle with lack of motivation, time-wasting, or even depression.

Freedom is only meaningful when you have a purpose to pour it into. Otherwise, it becomes a blank canvas that can feel intimidating or overwhelming.

Entrepreneurs vs. Employees: A Mindset Shift

Entrepreneurs rarely talk about retirement. Why? Because they see life as a continuous evolution of projects, ideas, and service. They don’t aim to stop working—they aim to work on things they love.

Contrast this with traditional employees, especially those who’ve lived paycheck to paycheck. The idea of not working often feels like falling off a cliff. Without intentional planning, they may struggle to adapt.

The Survivorship Bias of FIRE

The FIRE movement highlights the people who succeeded:

- High earners who saved aggressively

- People without children or dependents

- Individuals who benefited from investment windfalls

What we don’t often see are the silent majority who tried, failed, or quietly returned to work. Survivorship bias distorts our perception, making FIRE seem more attainable and permanent than it often is.

Inflation and Life’s Realities

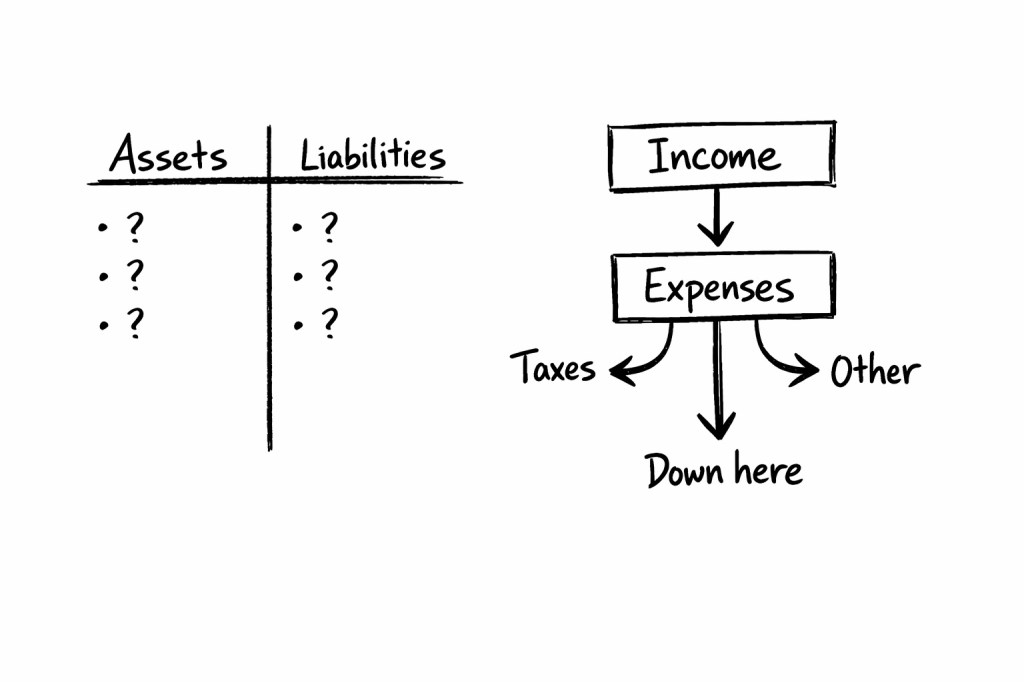

Many early retirement models assume a fixed lifestyle and static expenses. But life doesn’t work that way:

- Inflation eats away at your purchasing power

- Medical costs can explode as you age

- Emergencies and life changes are inevitable

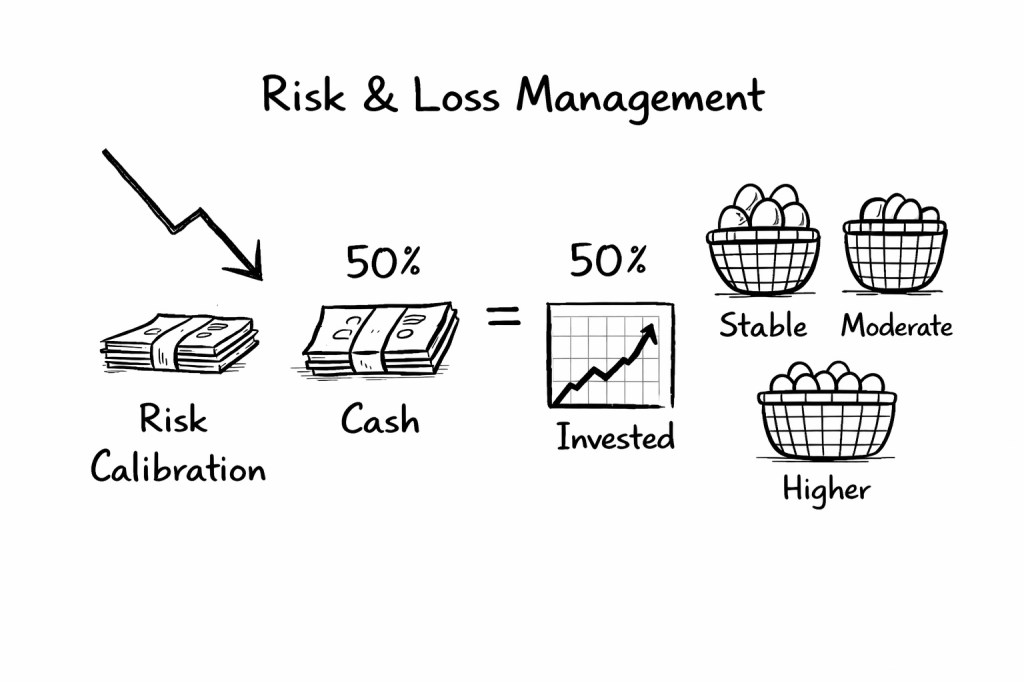

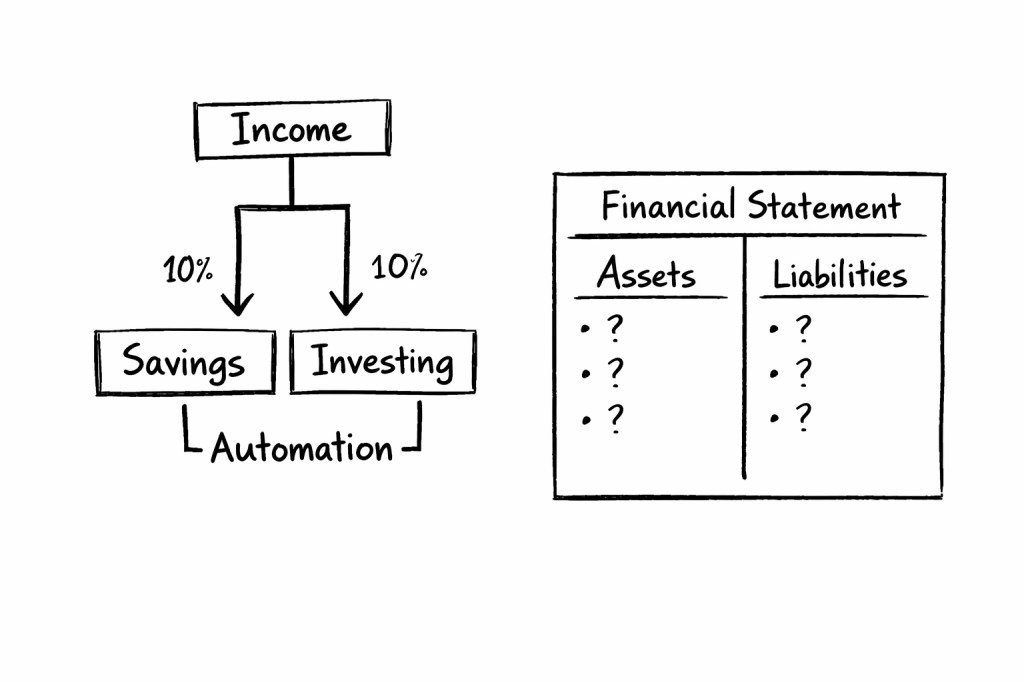

If your financial plan doesn’t account for change, it’s fragile. True financial freedom must include adaptability and resilience.

Loneliness and Social Disconnect

Retiring early often means your friends and peers are still working. That creates a disconnect:

- Fewer people to share time with

- A sense of being “out of sync” with the world

- Social isolation, especially if you move to a new location

This is why community and human connection must be part of your financial independence vision. Freedom without people to share it with can be hollow.

False Dichotomy: Work vs. Freedom

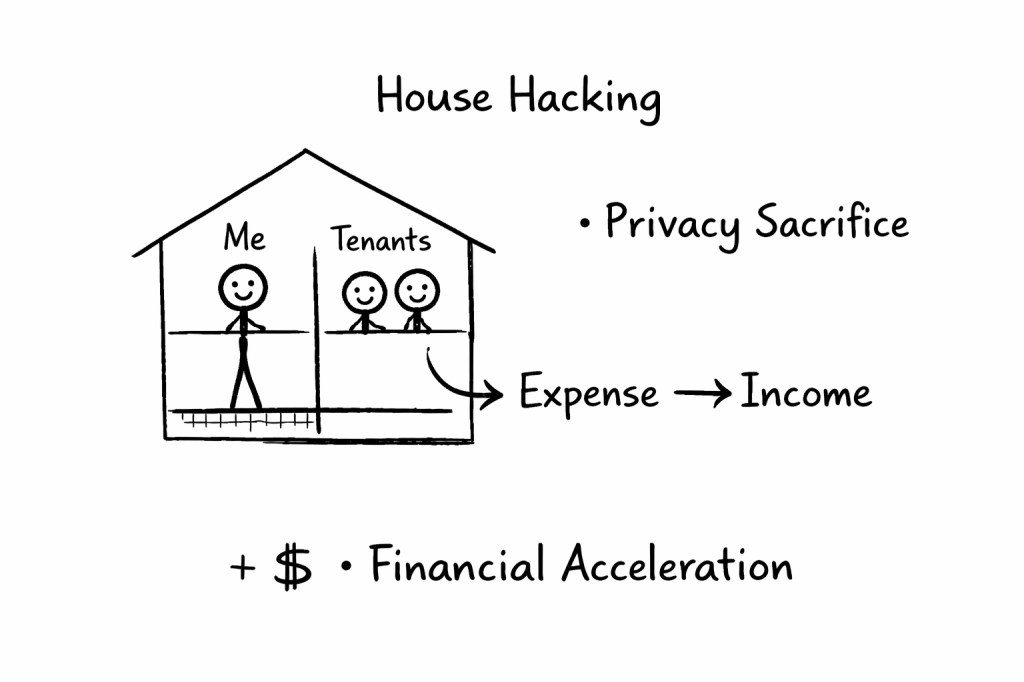

One of the most dangerous myths is the idea that you either work or you’re free. But there’s a middle path:

- Part-time passion work

- Meaningful volunteering

- Creative projects that bring joy and income

You don’t have to quit everything to feel free. You just need to take ownership of your time and energy.

Gradual Transitions Work Better

Instead of abrupt retirement, consider:

- Mini-retirements or sabbaticals

- Lifestyle downshifting

- Side projects while still employed

These gentle transitions help you experiment, adjust, and grow without shock or regret.

Keep Growing or Start Shrinking

It’s crucial to keep working on things that keep you active and growing as a person. Many people who’ve been stuck in the 9-5 matrix have forgotten what it’s like to learn something new. Once financially independent, learning becomes more difficult—but also more necessary.

A fulfilling life demands growth. Without it, life stagnates. People who retire and simply watch television, go drinking at the bar every day, or disengage from meaningful activity often spiral into depression or illness. That’s something worth avoiding at all costs.

Whether it’s learning a language, taking up photography, mentoring others, or building something with your hands—growth should be non-negotiable.

Financial Freedom Needs a Soul Plan

In the end, financial freedom isn’t the final goal. It’s the starting point. True wealth means having the resources, health, relationships, and purpose to live with intention.

So before chasing retirement, ask yourself:

- What would I do if I never had to work again?

- What matters more than money to me?

- What kind of life do I want to wake up to?

Conclusion: Retire the Word ‘Retirement’

Maybe we need a new word. Not retirement. Not quitting. But redesigning. A new chapter shaped by curiosity, service, creativity, and self-directed purpose.

Because the goal isn’t to stop working. The goal is to stop working on things that drain your soul and start living a life that lights you up.

Early retirement can be a gift—but only if you know what you’re really unwrapping.

Leave a comment